Welcome to the Market Cap Olympics!

The 2024 edition of the stock market showdown has been nothing short of a wild ride. Drama? Check. Triumphs? Oh, absolutely. Surprises? You bet! If you’ve ever wondered which companies are dominating the market cap leaderboard this year, you’re in the right place. Whether you’re new to investing, a casual observer, or a seasoned pro with an eye on mid-cap and small-cap stocks, we’ve got all the tea (and numbers) you need.

This year has been a rollercoaster, with old champions flexing their muscles and a few surprise underdogs making waves. We’re breaking down the biggest companies by market cap in 2024—the heavyweights ruling the corporate world. Who’s sitting on the throne? Which tech giants are still holding strong? Are any of those small-cap stocks you’ve been eyeing making big moves? Don’t worry, we’ve got it all covered.

Think of this blog as your ultimate financial scoreboard, but without the boring, stuffy jargon that makes your eyes glaze over. We’ll walk you through the top players, their market valuations, and the industries where they’re making big waves. And we’re not just dropping names—we’re throwing in real-world examples, juicy numbers, and even a sprinkle of predictions for good measure. Because let’s face it, what’s a leaderboard without a bit of forecasting?

Whether you’re here for the insights, the inspiration, or just to see who’s at the top of their game, this guide is your backstage pass to the stock market action of 2024. So grab a coffee, settle in, and let’s dive into the financial equivalent of the Olympics—because these market champs deserve a round of applause!

Why Market Capitalization Is the Ultimate Flex?

Let’s start with the basics: market capitalization—or market cap for short. Why does it matter? Well, it’s more than just a fancy number; it’s basically a company’s crown jewel. It tells us how big a company is, gives clues about its financial health, and shows just how much Wall Street vibes with its potential. If you’re sizing up a stock, market cap is your go-to stat to know who’s dominating the game and who’s on the rise.

Here’s the simple equation for the math-inclined (or those who just like knowing how things work):

Market Cap = Share Price x Total Outstanding Shares

That’s it! Easy, right? This magical number sorts companies into different leagues:

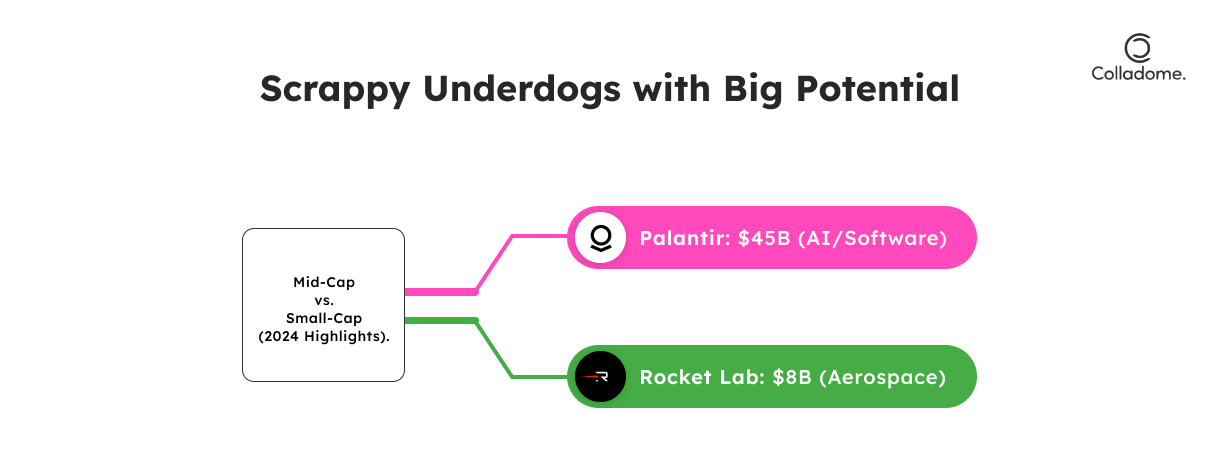

- Big-cap companies like Apple and Microsoft are the heavyweights, rocking trillions in market cap and leading the pack with sheer scale and influence.

- Mid-cap stocks are the scrappy underdogs. They’ve outgrown the small leagues but still have loads of growth potential to catch up to the big dogs.

- Small-cap gems are the wild cards. These companies are packed with risk and reward, and investors love betting on them for those potential big wins.

So, whether you’re into stable giants or high-risk, high-reward plays, market cap is the ultimate cheat code for sizing up your next investment move.

What Are the Top 10 Companies by Market Cap in 2024? Why They’re Killing It?

Let’s dive into the world of global market domination, where only the big players reign supreme. The top companies of 2024 have truly earned their market cap status, crushing it in sectors ranging from technology to energy. What sets them apart isn’t just their size but how they’ve mastered innovation and customer loyalty. These companies are powerhouses, not just because they have massive revenues, but because they continuously push the boundaries in terms of product development, service offerings, and strategic expansion.

They’re able to maintain insane profitability while adapting to market changes like shifts to AI, cloud computing, and the renewable energy transition. Their influence extends far beyond the stock market, shaping industries, defining trends, and, in some cases, transforming how we live our daily lives. From creating the latest must-have gadgets to pioneering in AI, financial services, and healthcare, these firms are not just playing the game—they’re setting the rules.

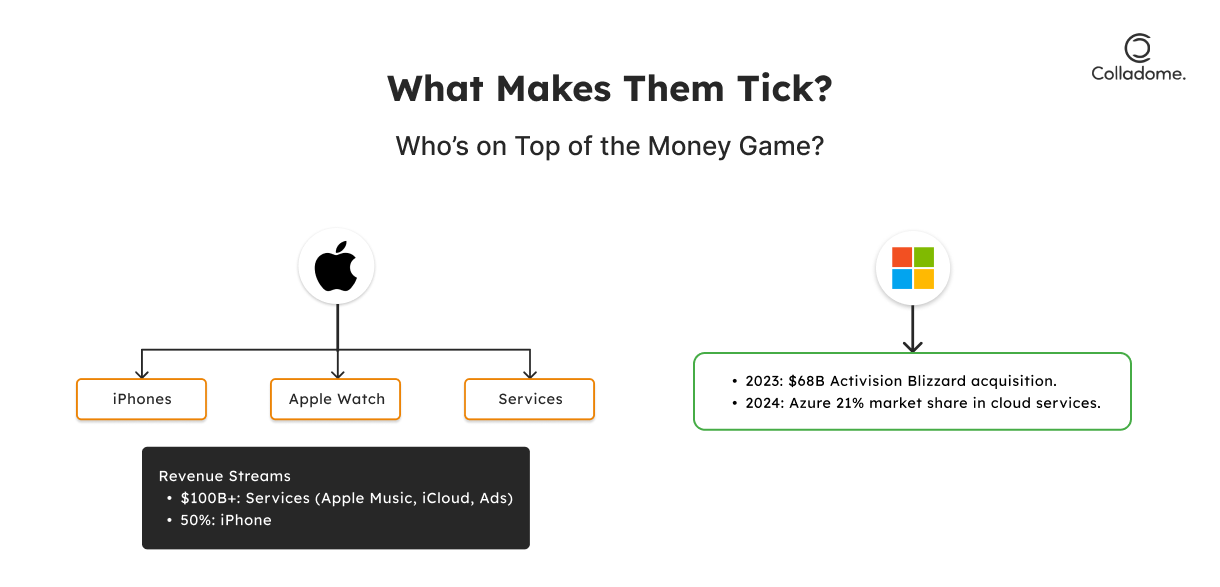

1. Apple ($3.2 Trillion)

What:

Apple is not just a technology company but a cultural icon. The iPhone, iPad, Apple Watch, and AirPods make up its product ecosystem, while Apple Music, iCloud, and Apple TV+ contribute to its fast-growing services division.

Why:

Apple’s brand loyalty is unmatched, with over 1.5 billion active devices in use worldwide. The services segment has grown to contribute over $100 billion in annual revenue, with Apple Music and iCloud among the key drivers. Apple’s seamless ecosystem of devices is pivotal to customer retention.

How:

Apple maintains its edge through constant innovation and ecosystem integration. In 2023, Apple’s iPhone sales alone made up about 50% of its revenue, while services, including digital advertising, generated $85 billion in revenue in 2022.

2. Microsoft ($2.8 Trillion)

What:

Microsoft, now a cloud computing and AI powerhouse, is a leader in cloud services through Azure, as well as in productivity tools with Office and Teams.

Why:

In 2023, Azure held a 21% market share in cloud services, just behind Amazon’s AWS, which dominates the sector. Additionally, Microsoft Teams has over 280 million monthly active users as of 2023.

How:

The company’s shift towards AI integration, like the ChatGPT partnership, and its $68 billion acquisition of Activision Blizzard to dominate gaming, shows its adaptability and growth trajectory.

3. Saudi Aramco ($2.3 Trillion)

What:

Saudi Aramco is the world’s largest oil producer, with the capacity to produce over 12 million barrels per day.

Why:

Despite global energy shifts, oil remains crucial, and Aramco’s oil reserves (over 260 billion barrels) are the largest of any company. The firm continues to benefit from the high volatility of oil prices, generating massive profits even during periods of low prices.

How:

In 2023, Saudi Aramco’s net income was over $160 billion, proving its resilience amid shifts in global energy markets and the pursuit of renewable investments.

4. Alphabet/Google ($1.8 Trillion)

What:

Alphabet, the parent of Google, runs the world’s most popular search engine and owns YouTube, Android, Google Ads, and much more.

Why:

Google has a 90% market share in global search, while YouTube has over 2.5 billion active users. Alphabet’s ad revenue in 2023 exceeded $250 billion, making it the world’s largest advertising network.

How:

Alphabet is heavily investing in AI development and autonomous vehicles (through Waymo), while its Google Cloud platform saw revenues surpass $30 billion in 2023.

5. Amazon ($1.5 Trillion)

What:

Amazon is the leading online retailer and also a giant in cloud computing through AWS.

Why:

Amazon’s AWS is one of the top cloud providers globally, with a 34% market share in the cloud services space as of 2023. Prime membership has surpassed 200 million subscribers worldwide.

How:

Amazon’s diversification into AI, robotics, and healthcare continues to expand its footprint. In 2023, Amazon’s net sales reached $500 billion, with AWS contributing over $80 billion.

6. Tesla ($1.2 Trillion)

What:

Tesla is the leader in electric vehicles (EVs), producing the Model 3 and Model Y, as well as innovations in energy storage and solar technology.

Why:

In 2023, Tesla sold over 1.3 million vehicles, making it the largest EV maker globally. Its Gigafactories enable it to scale production, and its Autopilot feature pushes the boundaries of autonomous driving.

How:

Tesla is pushing boundaries with energy solutions, like the Powerwall, and it’s investing heavily in robotaxi technology, aiming to dominate the next phase of autonomous mobility.

7. Nvidia ($1.1 Trillion)

What:

Nvidia is the global leader in graphics processing units (GPUs), which power everything from gaming to AI applications.

Why:

Nvidia’s GPUs are central to AI models and machine learning. Its dominance in the market continues, with Nvidia GPUs powering major AI applications, and its data center business surpassed $15 billion in revenue in 2023.

How:

Nvidia’s innovations in AI and deep learning technology have made it a critical player in self-driving cars and cloud gaming. The company’s market cap doubled in 2023, driven by the AI boom.

8. Berkshire Hathaway ($900 Billion)

What:

Berkshire Hathaway, Warren Buffett’s investment company, holds a massive portfolio of diversified businesses and stocks, including Geico, Duracell, and BNSF Railway.

Why:

Berkshire Hathaway’s diversified holdings enable it to thrive in various sectors, from insurance to railroads. It has consistently returned over 20% annual returns since Buffett took over in 1965.

How:

Berkshire’s focus on value investing, seeking businesses with strong fundamentals and competitive advantages, has resulted in over $100 billion in stock buybacks and investments.

9. Meta (Facebook) ($850 Billion)

What:

Meta owns Facebook, Instagram, and WhatsApp, making it the dominant social media network globally.

Why:

With 2.9 billion monthly active users across its platforms, Meta continues to dominate social media. Facebook and Instagram generate most of Meta’s ad revenue, which exceeded $100 billion in 2023.

How:

Meta’s major investments in the metaverse and virtual reality are part of its pivot, despite struggles with its Reality Labs division, which lost over $10 billion in 2023. Meta is still one of the largest advertising platforms, driving growth through social and immersive digital experiences.

10. TSMC ($750 Billion)

What:

TSMC is the world’s largest semiconductor manufacturer, producing chips for major tech companies like Apple, AMD, and Nvidia.

Why:

TSMC holds 54% of the global semiconductor market, and it’s a key player in manufacturing advanced chips, especially in 5nm and 3nm technology. The demand for these chips is rapidly growing due to the rise of AI, smartphones, and cloud computing.

How:

In 2023, TSMC generated $80 billion in revenue, with over 60% coming from its advanced chips. The company is investing in new production nodes to maintain its leadership in chip manufacturing.

Real-World Case Studies: Why These Giants Matter IRL

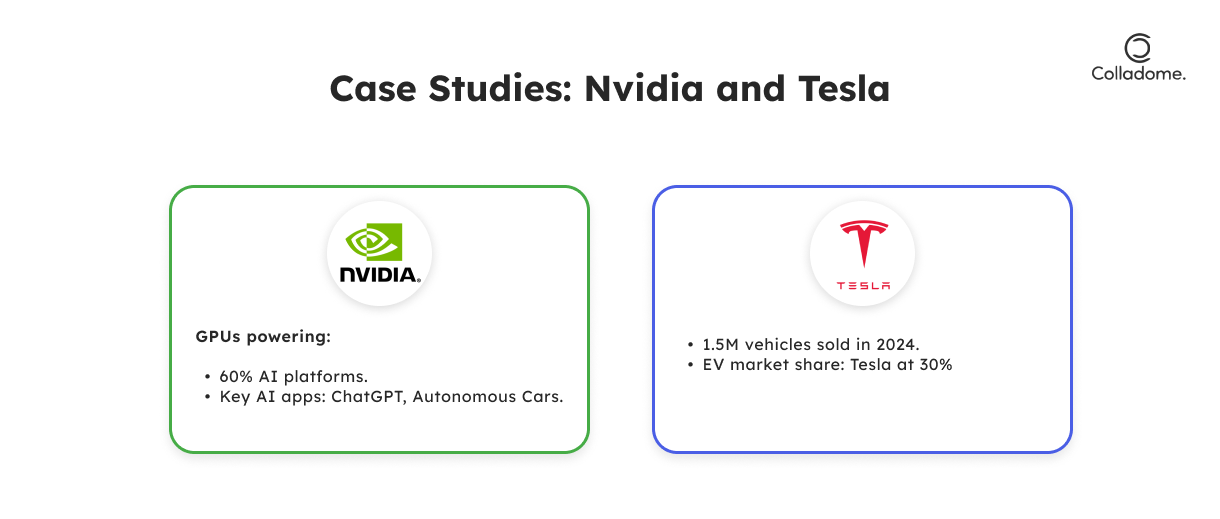

Case Study 1: Nvidia and the AI Boom

AI is everywhere right now, and Nvidia is right at the center of it all. Their GPUs (graphics processing units) are the secret sauce behind most of the AI and machine learning systems we’re seeing today — from generative AI tools like ChatGPT to autonomous vehicles and everything in between. If you’ve been keeping an eye on the stock market, you probably noticed Nvidia’s stock surge in 2024. The company’s stock went up by over 200% in just one year, making it one of the hottest investments around.

Investors are clearly betting on Nvidia’s role in powering the future of AI, and the numbers are backing that up. With AI demand growing rapidly, Nvidia’s technology is becoming indispensable. The company has positioned itself as the go-to provider for businesses diving deep into AI and machine learning, ensuring its dominance for years to come.

Case Study 2: Tesla’s EV Revolution

Tesla has officially shaken up the auto industry with the release of the Cybertruck in 2024. After years of hype, this futuristic-looking vehicle has finally hit the market, and people are pumped. The Cybertruck isn’t just a regular truck; it’s packed with cutting-edge AI-driven features, including advanced self-driving capabilities. But it’s not just about the truck itself — Tesla is proving it’s more than just a car company.

Tesla’s real game-changer is its ability to scale production. By increasing the number of Gigafactories, Tesla has been able to ramp up manufacturing and meet the growing demand for its electric vehicles (EVs). In 2024 alone, Tesla sold over 1.5 million vehicles, with a significant portion coming from its newer models like the Model Y and now the Cybertruck. This marks a huge milestone for Tesla as it aims to capture even more of the EV market.

Tesla’s focus on AI in its self-driving tech is another reason they stand out. While other automakers are playing catch-up, Tesla is already on the road to autonomous driving, with its Autopilot system continuously improving through data collected from its fleet of vehicles. As more drivers adopt EVs and self-driving features, Tesla’s market share in the EV world is set to grow.

Both Nvidia and Tesla are solid examples of how companies are shaping the future by tapping into cutting-edge technology and constantly innovating to stay ahead. Whether it’s AI or electric vehicles, these two are leading the way.

Facts, Figures, and Tables: Market Cap Leaders 2024

Here’s where the numbers do the talking.

Table 1: Top 10 Companies by Market Cap in 2024

| Rank | Company | Market Cap (Trillions $) |

| 1 | Apple | 3.2 |

| 2 | Microsoft | 2.8 |

| 3 | Saudi Aramco | 2.3 |

| 4 | Alphabet | 1.8 |

| 5 | Amazon | 1.5 |

| 6 | Tesla | 1.2 |

| 7 | Nvidia | 1.1 |

| 8 | Berkshire Hathaway | 0.9 |

| 9 | Meta | 0.85 |

| 10 | TSMC | 0.75 |

Table 2: Mid-Cap and Small-Cap Stars to Watch

| Type | Company | Market Cap (Billions $) | Sector |

| Mid-Cap | Palantir | 45 | AI/Software |

| Small-Cap | Rocket Lab | 8 | Aerospace |

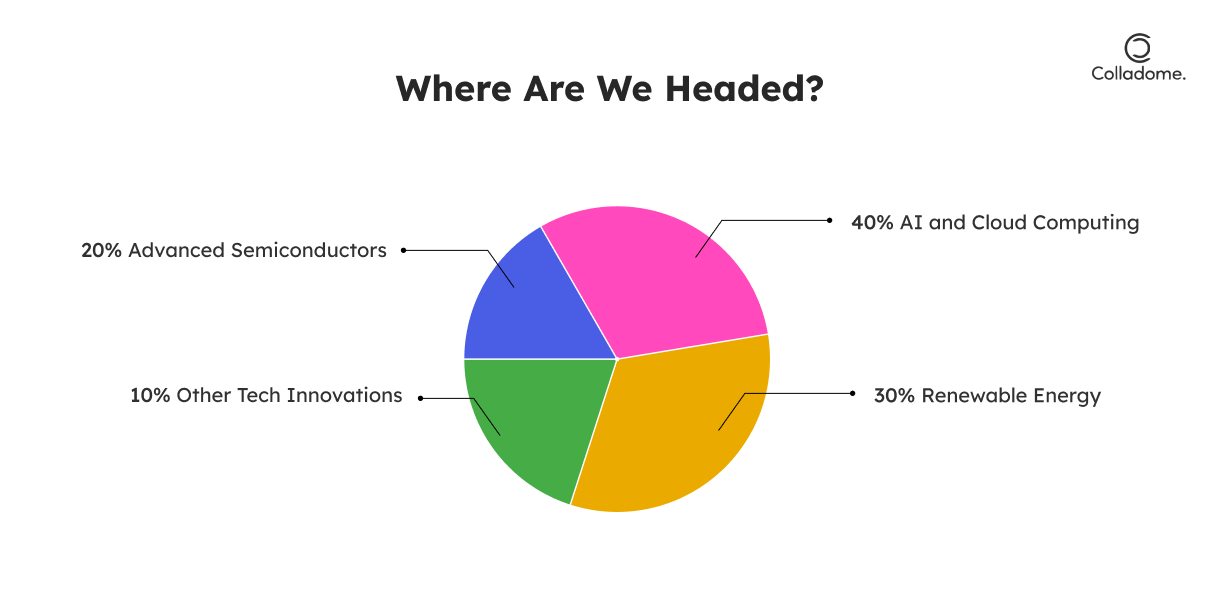

What’s Next for Top Market Cap Companies? Predictions for 2025 and Beyond

As we head toward 2025, the landscape for the world’s top companies is evolving. Here’s what to expect:

AI Boom Continues: The AI revolution is far from over, and companies like Nvidia and Microsoft are set to ride this wave even higher. Nvidia’s GPUs will continue to be the backbone of AI-driven technologies, from machine learning to autonomous driving. Meanwhile, Microsoft’s investments in cloud computing and AI tools (like ChatGPT integration) will keep them at the forefront of tech innovation.

Clean Energy Wins: The push toward sustainability is only intensifying, and Tesla is perfectly positioned to benefit. As governments double down on EVs and renewable energy, Tesla’s electric vehicles and energy storage solutions will see skyrocketing demand.

Geopolitical Shifts: Global trade patterns are shifting, and tech and energy companies will need to adapt. Supply chains and geopolitical tensions could force companies to rethink their global operations, making localization and diversification key strategies.

Expect a tech-driven future with sustainability and adaptability at the forefront.

Conclusion: The Market Cap Leaders of 2024 Are Just Getting Started

The Top Companies by Market Cap 2024 are more than just numbers—they’re shaping the world we live in. From Apple’s tech dominance to Nvidia’s AI revolution, these giants show us where the future is headed.